Picture this. You’re young and in love. No, not with your partner silly. With a house! You’ve found the home of your dreams.

It has a long driveway, spotlights down the sides, a tall door with a large reception and white marble floors. It’s perfect. After all your hard work, you’ve done it. You can actually afford this house.

“There’s just one thing,” the estate agent says. “It will likely be worth nothing once you buy it”.

“What? How likely?” you ask.

“90%….”

Ok, snap out of it. This is clearly hypothetical. I mean, who would ever make such a crazy investment?

Eric Dier, that’s who.

You see, buying a house is like starting a company. It’s an investment towards the life you want to live. But unlike homes, startups have an inherent flaw; they mostly go to zero. Eric’s hasn’t yet. But it will. Let me explain why.

There are two ways to start a company:

- Bootstrapped: Funding the business yourself or taking a loan.

- Funded: Raising money from venture capitalists in exchange for equity in your company (startup).

As a founder, your decision will depend on your goals. If you want to get rich and work for yourself, bootstrap. If you want to go big, and I mean huge, raise funding.

Taking on venture capital means you’re committed to going all out to land your investors a return. The problem is most startups run out of cash before they can.

Of course, the difference between the two isn’t that simple, and some ideas leave you with no choice.

Take social networks.

They need millions of users, genius tech teams and savvy marketers before they’re worth anything. This all costs money, and lots of it. But, if done correctly, they’re the perfect business. Think of it like owning an airport…

You have millions of people all in one place. If they want to fly, they have to sit at your airport, on your schedule. You can experiment with ways to keep them there for longer and test what they like most.

Then you can decide which businesses to place in each terminal, so people spend more money. It’s genius.

But before all of that, there’s an important rule to follow.

Solve a REAL pain point.

Eric broke this rule with his app, Spotlas. The idea is for users to recommend restaurants by posting pictures on their feeds. Sort of like Instagram meets TripAdvisor. See the problem?

It falls between a problem already solved and one not worth solving. Why?

Because Instagram flies you wherever you want. It’s a reviews app for foodies, a highlights channel for sports fans and playboy magazine for per…you get the point. To top it off, it has what I like to call the ‘scrollability factor’:

That thing that makes us check in early, buy some dinner and even get a massage while we wait. The magic that makes us mindlessly scroll in search of dopamine. Images of food don’t quite cut it.

“What about Tripadvisor?” you ask. “Aren’t they successful?” Sure, but hazard a guess as to why.

If your answer is because their company is like an airport…by George, I think you’ve got it!

They use search engine optimisation to rank for frequently asked questions and detailed reviews. Meaning we come to them, then they sell to us. Spotlas can’t do this; it’s an app. I mean have you ever googled a question and then downloaded an app to find the answer? Me neither.

Ok, let’s take a breather. There is some good news. I share these thoughts not to crush Eric’s dreams, but to give an insight into what success could look like.

Edwin land, the inventor of the Polaroid, framed it best when he said, “A mistake is a future benefit, the full value of which is yet to be realised”. The reasons Spotlas will fail will also be the catalyst behind Eric’s success. Here’s how:

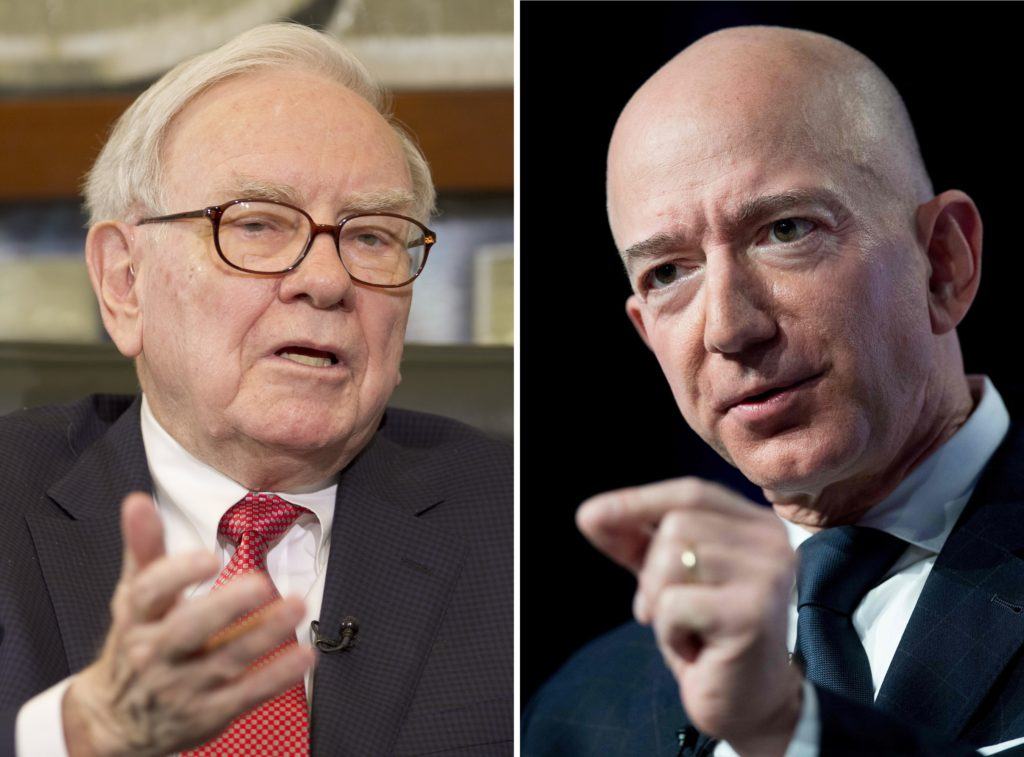

Bezos vs Buffett

Warren Buffett and Jeff Bezos are two of the wealthiest people on earth. But only one of them would likely be just as rich in a parallel universe. Let me explain.

Bezos is a genius. For all he’s achieved, he deserves immense credit. But consider all the entrepreneurs who were just as innovative but failed by trying to ‘go big’. For every Jeff Bezos, there are a thousand Geoff Bozos.

Meanwhile, there are tons of mini Buffets out there making hundreds of millions of pounds, taking a more assured approach.

If investing was a game, you’d be forgiven for accusing Buffett of using some form of cheat code. His holding company, Berkshire Hathaway, boasts $969B in assets. But what’s more staggering is that he built his wealth in a way that we all can. A way in which Eric has an unfair advantage.

Acquiring profitable businesses.

Buffett buys then builds. More commonly he sets and forgets. He doesn’t need to worry about that one big idea, product-market fit, or running out of cash. Instead, he acquires companies with already established employees, customers, and profits —everything Spotlas doesn’t have.

So Eric, if you’re reading this, don’t start a business… buy one. You’re better off trying to be Buffett than Bezos.